Forex trading, often abbreviated as Forex Trading, has become one of the most dynamic and fast-paced financial markets globally. With over $6.6 trillion traded daily, the foreign exchange market offers immense opportunities for those who know how to leverage its potential. However, navigating this complex market requires skill, strategy, and a clear understanding of its mechanics. Whether you’re a beginner or an experienced trader looking to sharpen your skills, these tips can help you master the art of forex trading.

Understand the Basics of Forex Trading

Before jumping into live trading, it’s essential to establish a solid foundation. The forex market involves trading currency pairs—such as EUR/USD or GBP/JPY—where one currency’s value is traded against another. Each currency pair has its own behavior, influenced by factors like geopolitical events, economic indicators, and market sentiment.

Start by learning the terminology, such as pips, spreads, leverage, and margin. Familiarizing yourself with these basics will help you make informed decisions and minimize beginner mistakes. Additionally, stay updated with financial news and currency trends to understand market dynamics better.

Develop a Solid Trading Plan

Discipline is critical in forex trading, and having a well-designed trading plan keeps you focused and consistent. A good trading plan should outline your entry and exit strategies, risk tolerance, and profit targets. For instance, determine in advance how much you’re willing to risk per trade and the reward-to-risk ratio you aim to achieve.

Backtesting your strategy on historical data and using demo accounts can help you refine your plan without exposing yourself to unnecessary risks. Remember, a winning plan requires both technical expertise and emotional discipline.

Utilize Technical and Fundamental Analysis

To trade forex successfully, you must utilize two primary approaches to analyze the market—technical analysis and fundamental analysis.

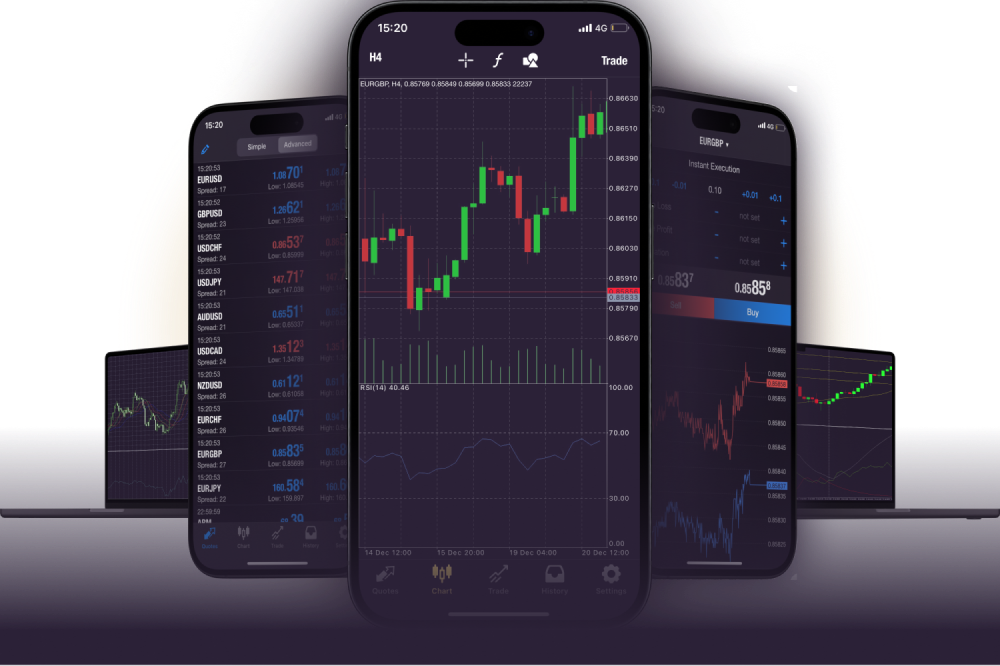

•Technical Analysis involves studying price charts, identifying patterns, and using indicators like moving averages or RSI (Relative Strength Index). This type of analysis helps you understand historical price movements and predict potential future trends.

•Fundamental Analysis, on the other hand, focuses on macroeconomic data, interest rates, and geopolitical news to assess currency value changes. For example, decisions by central banks or unemployment rates can significantly influence exchange rates.

Combining both types of analyses increases your chances of spotting profitable opportunities.

Practice Risk Management

Risk management is the backbone of successful forex trading. Even the most effective strategy can fail without proper risk controls in place. Always use stop-loss orders to limit potential losses and carefully calculate your position size based on your account balance.

Set realistic expectations and avoid over-leveraging your trades. While the potential for profits in forex trading is high, so is the risk. Balancing the two is key to sustained success.

Continuous Learning and Adaptation

The forex market changes constantly, influenced by global events and evolving trends. Staying ahead means committing to continuous learning. Read books, follow trusted financial blogs, and participate in webinars to keep up with the latest strategies and tools.